In recent years, as China's economy has entered the New Normal, China's metal products industry is also facing the challenge of transformation and upgrading. After joining the World Trade Organization, China's metal products industry has experienced industrialization and achieved rapid development, with the production of important products such as wire rod products, containers, mechanical components, and metal containers ranking first in the world.

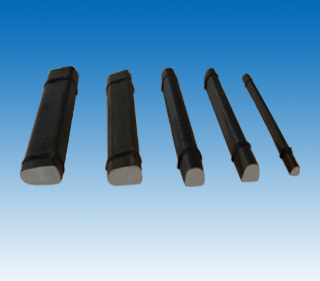

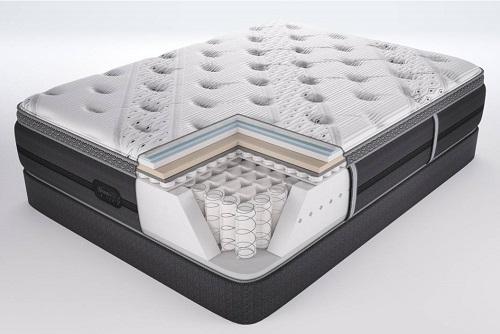

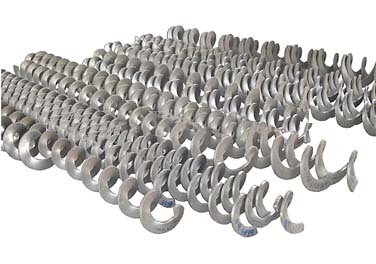

(Information pictures are for reference only)

1、 Overview of the Metal Products Industry

The metal products industry includes the manufacturing of structural metal products, metal tool manufacturing, container and metal packaging container manufacturing, stainless steel and similar daily metal products manufacturing, etc. With the progress of society and the development of technology, metal products are increasingly used in various fields such as industry, agriculture, and people's lives, creating greater value for society.

The metal products industry includes the manufacturing of structural metal products, metal tools, containers and metal packaging containers, stainless steel, and similar daily metal products. In recent years, with the implementation of preferential policies in relevant industries, China's metal products industry has achieved rapid development.

Non ferrous metal products are a type of non-ferrous alloy that is processed from non-ferrous metals. Non ferrous alloys are alloys formed by adding one or several other elements to a non-ferrous metal matrix. Non ferrous alloys generally have higher strength and hardness than pure metals, higher resistance and lower temperature coefficient of resistance compared to pure metals. They have good comprehensive mechanical properties and are the basic materials for the development of the national economy. The vast majority of industries such as aviation, aerospace, automotive, mechanical manufacturing, power, communication, construction, and home appliances are based on non-ferrous metal materials for production.

The metal product industry has also encountered many difficulties in its development process, such as a single technology, low technical level, lack of advanced equipment, talent shortage, etc., which have constrained the development of the metal product industry. To this end, measures can be taken to improve the technological level of enterprises, introduce advanced technology and equipment, and cultivate suitable talents to enhance the development of China's metal products industry.

2、 Market Status of Metal Products Industry

Many developed countries such as Europe, America, and Japan have accumulated rich experience in the field of metal skins, including strict standards for the production of metal sheets and complete technology. High performance aluminum alloys, magnesium alloys, and titanium alloys are increasingly widely used in fields such as aerospace, military, automotive, and power equipment. Especially with the development of the automotive industry, the application of high-performance alloys in vehicles is rapidly increasing, and their market demand is increasing.

In recent years, as China's economy has entered the New Normal, China's metal products industry is also facing the challenge of transformation and upgrading. After joining the World Trade Organization, China's metal products industry has experienced industrialization and achieved rapid development, with the production of important products such as wire rod products, containers, mechanical components, and metal containers ranking first in the world.

With the increase in the number of Chinese metal products industry enterprises, total assets have also increased. In 2020, the total assets of China's metal products industry reached 3115.17 billion yuan, an increase of 1191.57 billion yuan compared to 2019, a year-on-year increase of 3.98%. As of October 2021, the total assets of China's metal products industry had reached 3498.82 billion yuan, of which current assets were 2308.18 billion yuan.

According to the "Research Report on the Development Trends and Strategies of the Domestic Metal Products Industry from 2023 to 2028" by China Research Institute of Industry:

The importance of metal products industry in the national economy is gradually increasing, but with the domestic economic development entering the New Normal, China's metal products industry is facing many challenges. On the one hand, the cost price of metal products is increasing, and the surplus of products makes it difficult for commodity prices to rise accordingly, increasing the cost pressure on metal product enterprises. However, in order to cope with the brutal competitive situation, we have to adopt a method of compressing profit margins.

Data shows that in 2020, the operating revenue of China's metal products industry was 3681.41 billion yuan, and the operating cost was 3211.87 billion yuan; In 2021, the operating revenue of China's metal products industry was RMB 4683.54 billion, and the operating cost was RMB 409.71 billion.

According to data from the National Bureau of Statistics, the export value of metal products, machinery, and equipment repair industry in China in August 2022 was 3.64 billion yuan, a year-on-year increase of 43.8%; From January to August 2022, the cumulative export value of the national metal products, machinery, and equipment repair industry was 21.19 billion yuan, a year-on-year increase of 11.2%; The export value of metal products, machinery, and equipment repair industry in China reached its maximum in 2017 from 2015 to 2021.

From January to August 2022, the proportion of the national metal products, machinery, and equipment repair industry (under the manufacturing industry) to the export value of the manufacturing industry was 0.21%. From January to August 2022, the proportion of the metal products, machinery, and equipment repair industry in Guangdong Province to the export value of the manufacturing industry in the region was 0.13%; In August 2022, the export value of metal products, machinery, and equipment repair industry in Guangdong Province was 502 million yuan, accounting for 13.8% of the national export value of metal products, machinery, and equipment repair industry.

3、 Development Trends of the Metal Products Industry

With the continuous deepening of economic globalization, social progress, and rapid technological development, the market expansion scope of China's metal products industry is also increasing. Enterprises are occupying the market and expanding their scale through various means such as overseas trade and e-commerce. The Chinese metal products industry is entering a golden period of industry development.

In recent years, the overall profit of the industry has decreased significantly, while the profits of leading enterprises have maintained growth, indicating that the operating efficiency of powerful enterprises has steadily improved, and the profitability of small and medium-sized enterprises has weakened, dragging down the overall profit level of the industry. From this, it can be seen that the development of China's metal products industry is relatively chaotic and still faces many problems that need to be improved. In the future, adjusting the industrial structure and promoting the healthy development of the industry is still an urgent matter.

The importance of metal products industry in the national economy is gradually increasing, but with the domestic economic development entering the New Normal, China's metal products industry is facing many challenges. On the one hand, the cost price of metal products is increasing, and the surplus of products makes it difficult for commodity prices to rise accordingly, increasing the cost pressure on metal product enterprises. However, in order to cope with the brutal competitive situation, we have to adopt a method of compressing profit margins.

At present, due to the continuous expansion of industry production capacity, the market supply exceeds demand, and the problem of inventory compression in the industry is severe. This has led to increasingly fierce market competition and continuous decrease in product prices, resulting in a decrease in the overall profit of the industry. Therefore, adjusting the industrial structure and promoting the healthy development of the industry is still an urgent matter, and large-scale and intensive development will be the trend. In the future, the operating pressure of small and medium-sized enterprises will continue to increase, and small enterprises will gradually be eliminated by the market.

The research report on the metal products industry mainly analyzes the market size, supply and demand situation of the metal products market, competition situation in the metal products market, business operations of major enterprises in the metal products market, and market share of major enterprises in the metal products market. At the same time, scientific predictions are made for the future development of the metal products industry. The research report on the metal products industry can help investors analyze the market situation of the industry in a reasonable manner, make industry prospects predictions for investors to invest, explore investment value, and provide suggestions on industry investment strategies, production strategies, marketing strategies, and other aspects.

To learn more about the detailed analysis of the metal products industry, you can click to view the research report "Research Report on the Development Trends and Strategies of the Domestic Metal Products Industry from 2023 to 2028" by Zhongyan Puhua.